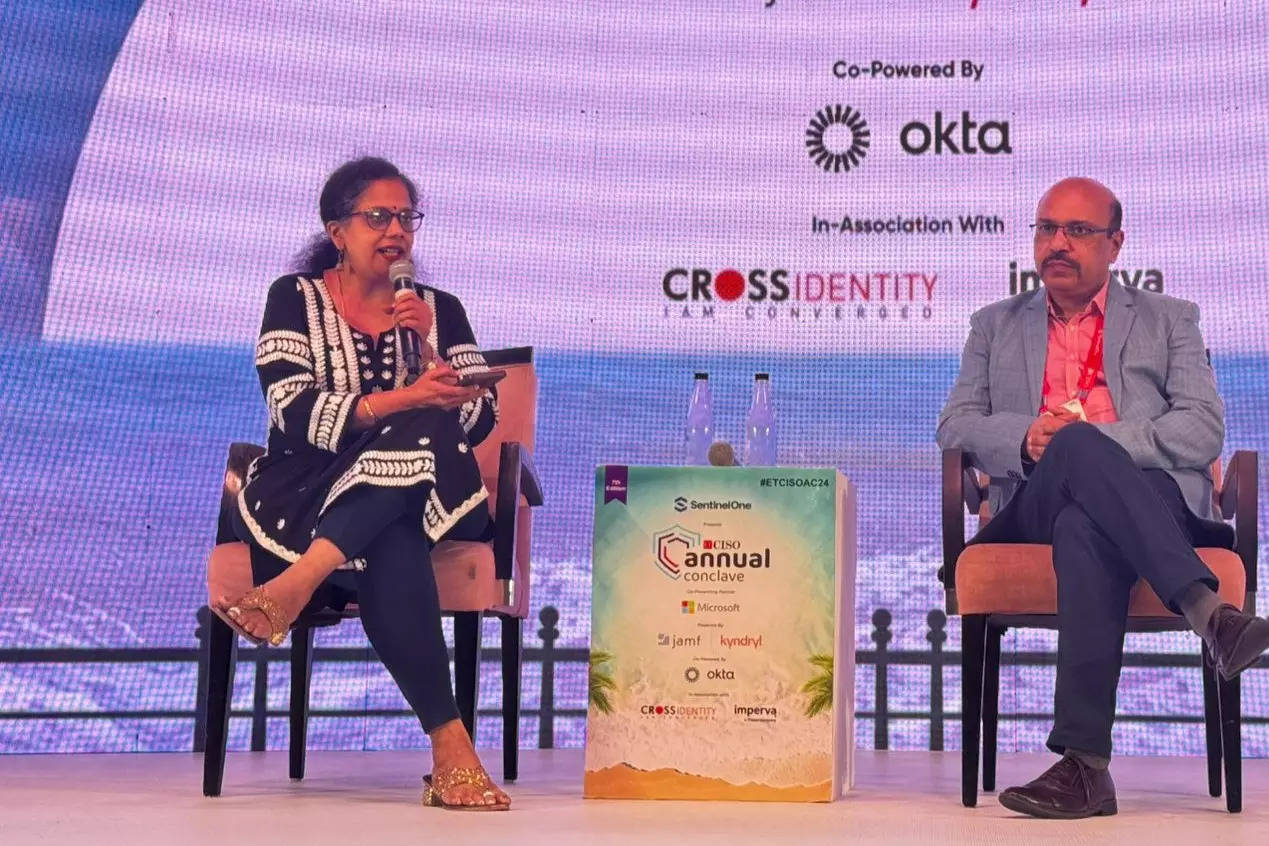

Abhijit Chakravarty, EVP, Kotak Bank, ET CISO

Banking and capital market firms have made significant strides in both preventing cyberattacks and recovering faster than many other industries. Their constant interactions with partners and collaborators place them in a unique position where a robust cyber resilience strategy is not just desirable but essential. Speaking on the sidelines of the ETCISO Annual Conclave 2024, Abhijit Chakravarty, EVP at Kotak Bank, unpacks the challenges and approaches in creating a cyber-resilient enterprise.

“Resilience means how soon can you bounce back. Financial institutions in the past 2-3 years have built incident responses. The capability of detection is much higher than incident response—as it requires a lot of coordinated effort,” Chakravarty explained.

The real challenge, he pointed out, lies in the aftermath of an incident. For effective resilience, organizations need a platform that integrates a wide array of technology stacks to coordinate remediation efforts seamlessly. “To enable that, one needs a platform that allows you to integrate a lot of technology stacks and orchestrate remediations. Post remedial, what’s the capability to simulate and check for effect. This continues to be a challenge.”

With cybersecurity becoming integral to business operations, measuring the return on investment (RoI) in security initiatives is a pressing concern for many enterprises. Chakravarty emphasized the importance of reducing complexities: “With multiple tech stacks, what bothers is integration and compatibility between various teams involved. Look for platform-based services—you get a single platform, cut down complexities, and operational hazards.” By adopting platform-based solutions, banks can streamline their security operations, achieving both cost efficiency and an enhanced security posture.

Kotak Bank’s approach to cyber resilience highlights the need for a proactive strategy, where seamless integration and rapid response capabilities form the core of a robust defense framework.

Firewall Security Company India Complete Firewall Security Solutions Provider Company in India

Firewall Security Company India Complete Firewall Security Solutions Provider Company in India